harshad-mehta-bull-run rajkotupdates.news: A Financial Phenomenon

Introduction

harshad-mehta-bull-run rajkotupdates.news : The Harshad Mehta Bull Run, often referred to as one of the most remarkable events in India’s financial history, continues to intrigue and captivate financial enthusiasts even years after it occurred. This article delves into the captivating story of the Harshad Mehta Bull Run, its origins, impact, and the lessons learned from this unprecedented financial phenomenon.

Also read : https://sarangbos.com/windows-11-rajkotupdates-news-know-all-about-2/

The Rise of Harshad Mehta

Early Life and Entry into Finance

Harshad Mehta, born in a modest family, rose to fame as a stockbroker and gained prominence during the late 1980s and early 1990s. His journey from working as a salesperson to becoming a charismatic and influential figure in the Indian stock market was nothing short of extraordinary.

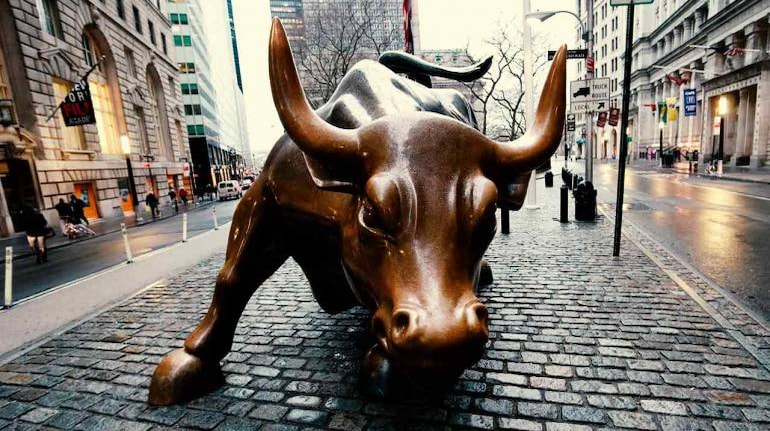

The Big Bull and His Strategies

Mehta earned the nickname “The Big Bull” due to his bullish approach in the market. His modus operandi included exploiting loopholes in the banking system to manipulate stock prices, a practice now infamously known as “Harshad mehta bull run rajkotupdates news : The Harshad Mehta Scam.” He ingeniously used ready forward (RF) deals to artificially inflate the prices of certain stocks.

The Bull Run Unleashed

Driving Stock Prices to Unprecedented Heights

During the early 1990s, Mehta’s influence over the stock market reached its zenith. He successfully orchestrated a massive surge in stock prices, causing the Bombay Stock Exchange (BSE) index to skyrocket to unprecedented heights. Investors and traders were drawn to the market by the allure of quick riches, as Mehta’s tactics created an atmosphere of euphoria.

The Domino Effect

As stock prices soared to unimaginable levels, more investors poured into the market, hoping to benefit from the ongoing bull run. The media fueled the frenzy, reporting on the seemingly endless rise in stock prices. However, beneath the surface, the entire system was built on a fragile foundation of manipulated funds.

The Collapse and Aftermath

Exposing the Scam

The exuberance of the bull run came to an abrupt halt when journalist Sucheta Dalal and her colleague Debashis Basu exposed the irregularities and Harshad mehta bull run rajkotupdates news : unethical practices within the market. Their relentless investigation brought to light the dubious mechanisms that Mehta had been exploiting to fuel the bull run.

The Fall from Grace

In the aftermath of the revelation, panic gripped the market. Stock prices plummeted, wiping out fortunes overnight. Mehta’s empire crumbled, and he was arrested for his involvement in the scam. The financial havoc left many investors in turmoil, leading to investigations, lawsuits, and a prolonged period of market recovery.

Lessons Learned

Regulatory Reforms

The Harshad Mehta Bull Run underscored the need for stricter regulatory measures in the Indian financial sector. The Securities and Exchange Board of India (SEBI) was empowered and revamped to prevent such large-scale manipulations in the future.

Market Volatility and Caution

Investors became more cautious and aware of the potential risks associated with market volatility. The episode highlighted the importance of due diligence, Harshad mehta bull run rajkotupdates news : ethical practices, and the perils of blindly following trends without understanding the underlying fundamentals.

Conclusion

rajkotupdates news :Harshad Mehta Bull Run remains an iconic chapter in India’s financial history, a cautionary tale of the dangers of unchecked power and manipulation in the market. As the financial world continues to evolve, the lessons from this episode serve as a reminder that transparency, regulatory vigilance, and ethical practices are the cornerstones of a healthy and resilient financial ecosystem.

FAQs

-

What was the Harshad Mehta Bull Run?

- The Harshad Mehta Bull Run was a period of unprecedented stock market growth orchestrated by Harshad Mehta, an influential Indian stockbroker.

-

How did Harshad Mehta manipulate the market?

- Mehta used techniques like ready forward deals to inflate stock prices artificially, creating a false sense of market growth.

-

Who exposed the Harshad Mehta Scam?

- Journalists Sucheta Dalal and Debashis Basu played a crucial role in exposing the irregularities in the market, leading to the downfall of the bull run.

-

What were the repercussions of the bull run’s collapse?

- The collapse led to a market crash, wiping out fortunes and revealing the vulnerabilities of the financial system.

-

What lessons were learned from the Harshad Mehta Bull Run?

-

The bull run highlighted the need for stricter regulations, ethical market practices, and investor caution in the face of market volatility.